Build and Run Digital Banking

Hyozan (氷山) means "Iceberg" in Japanese. 90% of effort, time and budget is hidden below the tip of the digital iceberg

Our mission: provide digital as an end-to-end managed service for consumer financial institutions.

We build, manage and enhance your processes and platforms around digital banking, acquisition, and servicing.

Hyozan Platforms for digital

Platforms for Digital Prospecting, Onboarding, Servicing & Engagement

Flexibly manage digital content

Hyozan's advanced banking content management platform enables build and maintainance of the best digital content across digital assets.

Advanced integrated analytics

Over and above commercial analytics tools, Hyozan provides integrated analytics capabilities that can provide you with insights into visitors, prospect probability, correlation of prelogin and postlogin behaviors as well as capability to build propensity models around conversion.

Lead nurturing CRM

Hyozan's advanced lead management CRM consolidates digital leads, and

provides a transparent and efficient process for customer service agents

to nurture and convert these leads.

Lead analytics and sales productivity analytics ensure maximum conversion

and sales efficiency.

Instant digital onboarding

Fully remote digital account opening for savings, deposits, credit cards, loans and more, with full KYC and account verification. Leverage the power of digital public infrastructure, AI, video interactions and the fintech ecosystem to drive account growth and customer satisfaction.

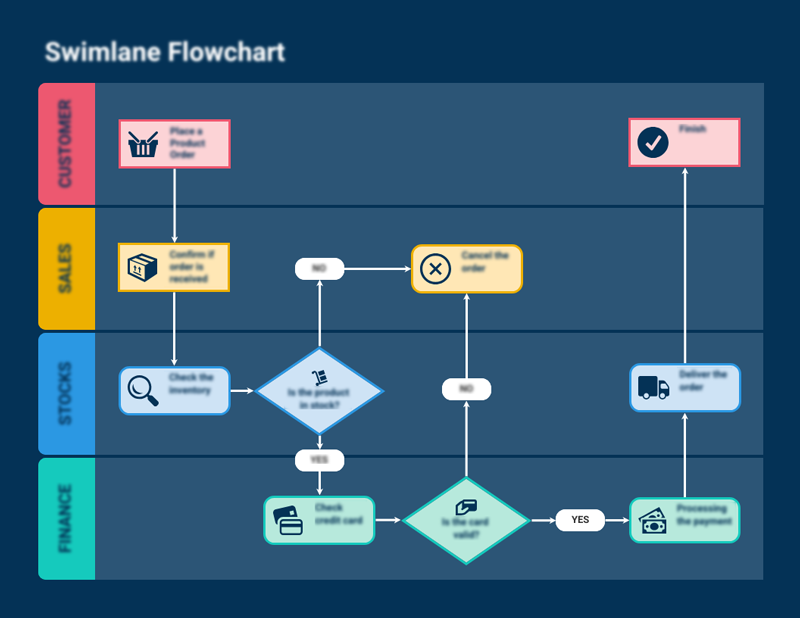

Hyozan process discipline for digital

Running a digital business efficiently and with compliance requires more than

just cutting edge platforms and features.

It is important to have the right process discipline with the correct checks

and balances across the organization.

Hyozan brings you the right set of processes to build a sustained digital presence,

and Hyozan staff operate your digital assets in adherence to these processes.

A few sample process overviews are highlighted below.

Process Framework

Hyozan process documents address

- Key risk areas

- Critical checkpoints to address risks

- Standard operating procedures

- Audit deliverables

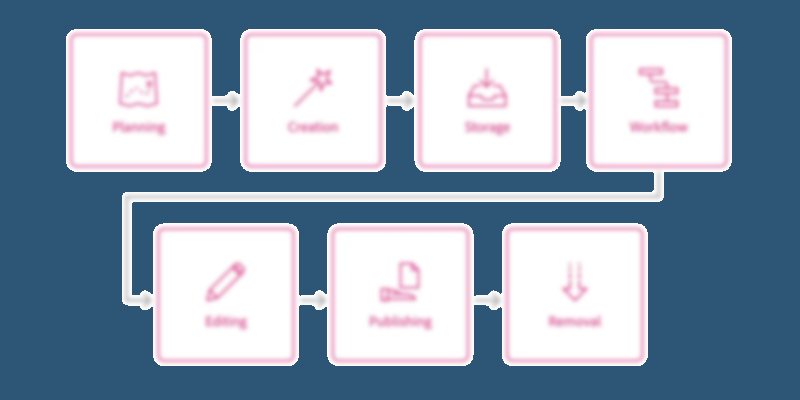

Content Management Process

Ensure that digital content including websites, social media, digital marketing

as well as customer communications are managed with the right level of approvals

and reviews.

A common regulatory audit scenario is to restore archived as of a

historical point in time and also demonstrate that content was reviewed and approved

as per policy.

Customer contact process

Ensure adherence to privacy laws, customer preferences and prevent phishing and other fraud. It is also critical to appropriately handle scenarios where customer cannot be contacted due to invalid email / phone number etc.

Digital onboarding process

Ensure systematic adherence to regulations around KYC, Anti Money Laundering,

fraud prevention etc., while also having a consistent level of customer experience.

Also ensure reconciliation of financial flows for client account funding

or disbursements.

Complaint management

A customer complaint addressed correctly transforms the customer experience

and converts the customer into an advocate for the organization.

Hyozan customer complaint tracking process is integrated into the Hyozan CRM

and also tracked at the management level.

Cloud adoption policy

While cloud provides unmatched convenience, time to market and potential cost

savings, there are risks around security, data residency, cost control and

regulatory compliance.

Hyozan processes build a solid cloud management process from day one.

What makes Hyozan unique?

Regulated financial institutions choose Hyozan because of focus on Governance, Process and Agility.

Global Banking Experience

Hyozan founders have over 25 years of building and managing digital banking at world-class financial institutions, with deep exposure to technology, regulations and banking.

Process Discipline

Detailed auditable processes at a granular level are baked into Hyozan from day one.

Audit trails, control checkpoints and adherence to regulatory guidelines are

available to you.

Security

Hyozan processes and platforms are designed with enterprise grade security in mind, with full compliance to regulatory requirements as well as world-class financial institution level security.

Digital Operations Center

Hyozan operations staff provide dedicated 24x7 monitoring of the end-to-end digital stack. Any issues are spotted immediately and resolved within stringent SLA

Business Continuity Planning

Full business continuity planning coupled with regular drills are baked into Hyozan platforms and processes. Hyozan systems are architected with built in multiple redundancy and careful design to ensure no single point of failure.

Serverless Cloud

Serverless cloud infrastructure employed throughout Hyozan means that operating costs are minimized, while it is possible to spin up multiple testing and staging environments in a matter of minutes

Standards compliance

Hyozan processes and platforms are architected to comply with global and international standards such as PCI-DSS, GDPR, ISO 27001 as well as digital / payment guidelines issued by regulators such as MAS, CBUAE, RBI etc.

Contact Us

Drop us a mail at contact (at) hyozan.com

Follow us on LinkedIn

About Hyozan

Hyozan Solutions Pte Ltd (Singapore) has been founded with

a mission to provide Digital Banking as an end-to-end managed

service for consumer Banks and other small financial institutions

across South East Asia, India, Middle East and Africa.

Hyozan will build and maintain platforms around

Digital Acquisition, Digital Marketing and Digital Banking in the consumer

financial sector.

Hyozan will provide these as a fully managed service to

client organizations.